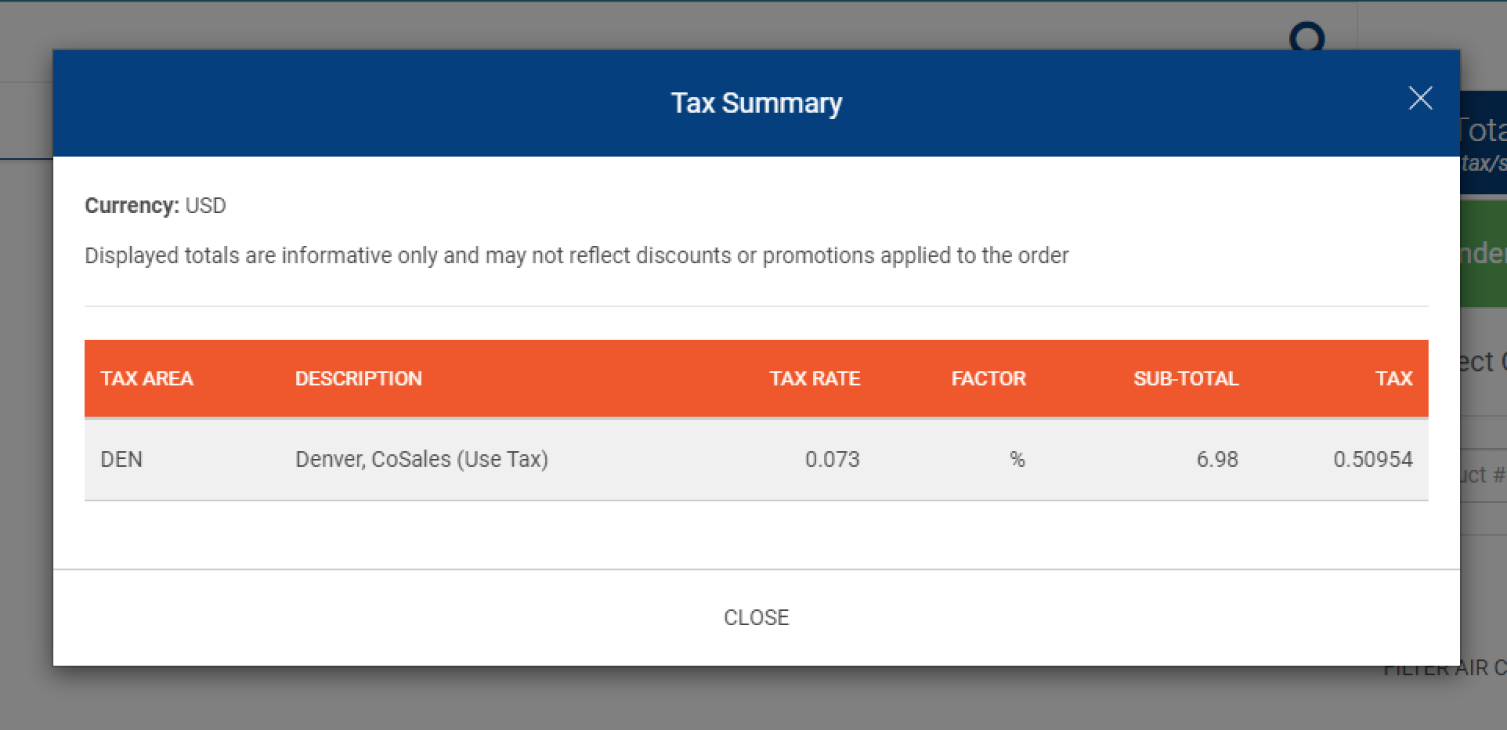

Tax Summary

There may come a time when a customer is concerned about or questions the tax amount on an order. The Tax Summary screen will help you explain to the customer how tax was calculated for the order. The tax area(s) that currently apply to the order will be displayed. You will also see the tax rate that was applied and the tax per tax area.

AvaTax Hold Code for Tax Revision

Sales > Settings

In Digital Commerce when an error is encountered attempting to calculate tax a message will be shown alerting the web user that tax could not be calculated and the order may be subject to tax later. In Point of Sale when tax cannot be calculated a message will be shown and the process stopped. With permissions the POS user may continue. If the error is bypassed, the order will not go on this hold.

Tax explanation code for Vertex

Sales > Settings

For Vertex users only - A user defined code (00/EX) that controls how a tax is assessed and distributed to the general ledger revenue and expense accounts