Store and Company Setup

Store Setup within JDEdwards

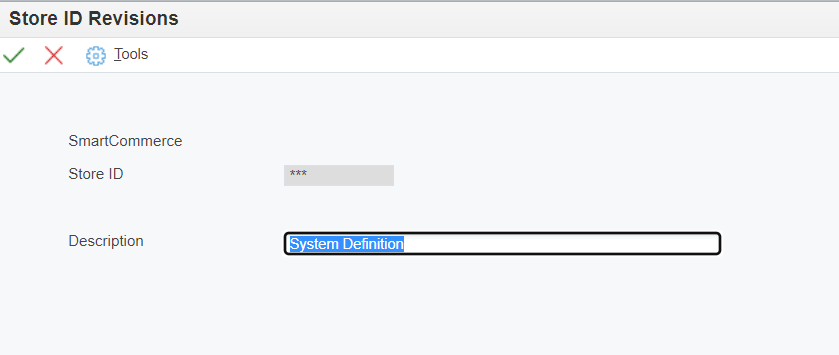

A Store represents a particular type of business within the organization with a common set of business rules. Stores must be setup utilizing the Work with Stores application (PQ670001). For Avalara AvaTax only ‘***’ – System Definition is required to be defined. Other stores are used for SmarterCommerce Point of Sale.

Company Settings

In the Avalara AvaTax Administrator Console

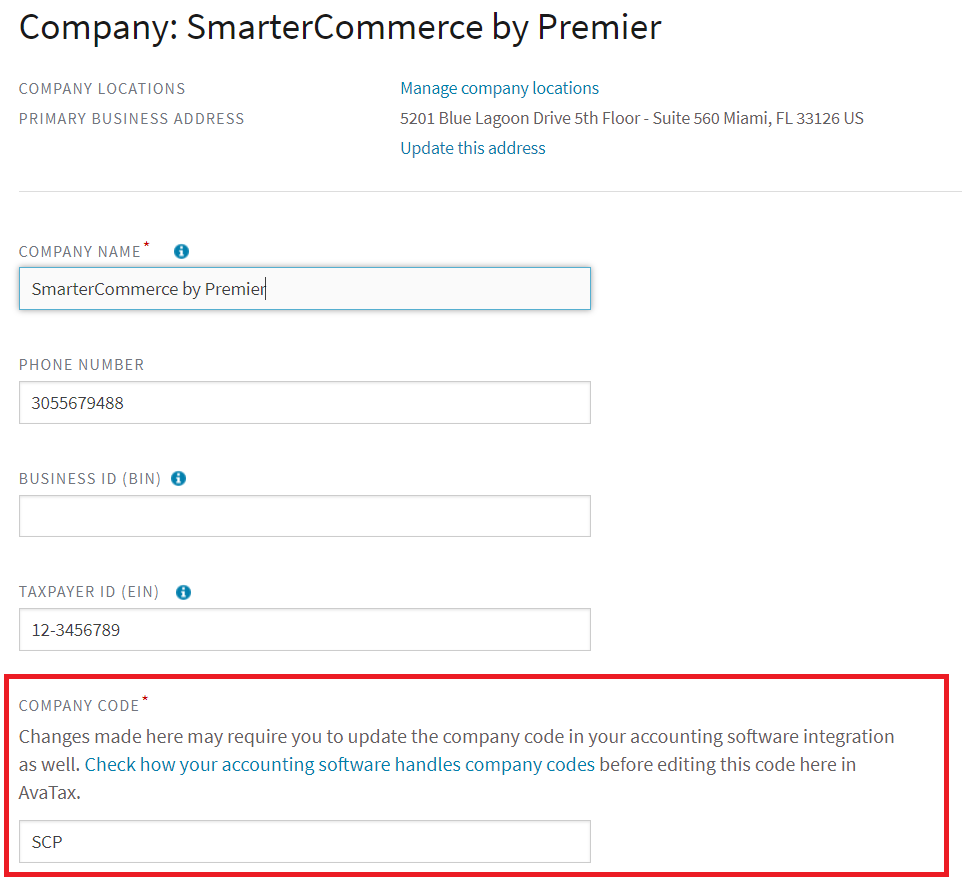

You get to create your own company code. Your company code helps AvaTax access your company's tax profile (it can have a maximum of 25 characters). Create a company code and write it down. Many customers choose a three to five letter abbreviation for their company. During the account activation process in the Administrator Console, you will be asked to enter the code you created in the Company Code box.

In the SmarterCommerce Tax Processing Console

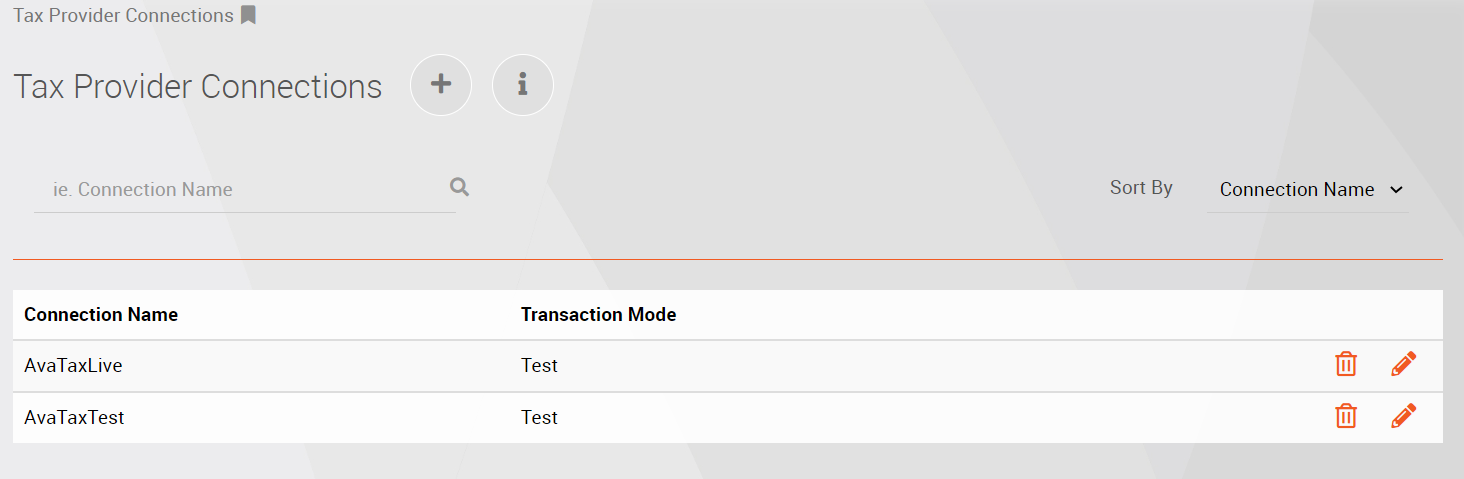

In Tax Provider Connections define a connection.

In JDEdwards

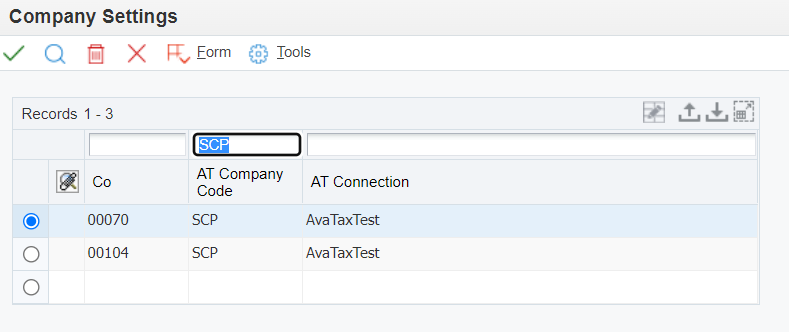

Within Company Settings application (PQ67ATSY) map each JD Edwards company which will calculate tax utilizing Avalara AvaTax Get Tax functionality to its respective Avalara AvaTax Company Code (A case-sensitive code that identifies the company in the Avalara AvaTax account in which the document should be posted. This code is declared during the company setup in the Avalara AvaTax Admin Console as shown above.) In addition, map each JD Edwards company to its respective Avalara AvaTax (AT) Connection Name created in the SmarterCommerce Tax Processing Console (A connection name defines the Avalara AvaTax Account and License to be utilized – see Avalara AvaTax (AT) Connections below.)

Provider Settings

Within Company Settings (PQ67ATSY) take the form exit to Provider Settings and verify that provider settings have been configured based on provided installation guide recommendations, Server Name (the name of the server), Environment (the JDE Environment), Provider Name (example “AT4000”), API Path (the path where the libCurl was installed), URL Path (Tax Processing Console URL). If provider settings seem to be missing or appear to be incorrect, please contact your system administrator. Avalara AvaTax Get Tax calculation will not function properly without appropriately configured provider settings.

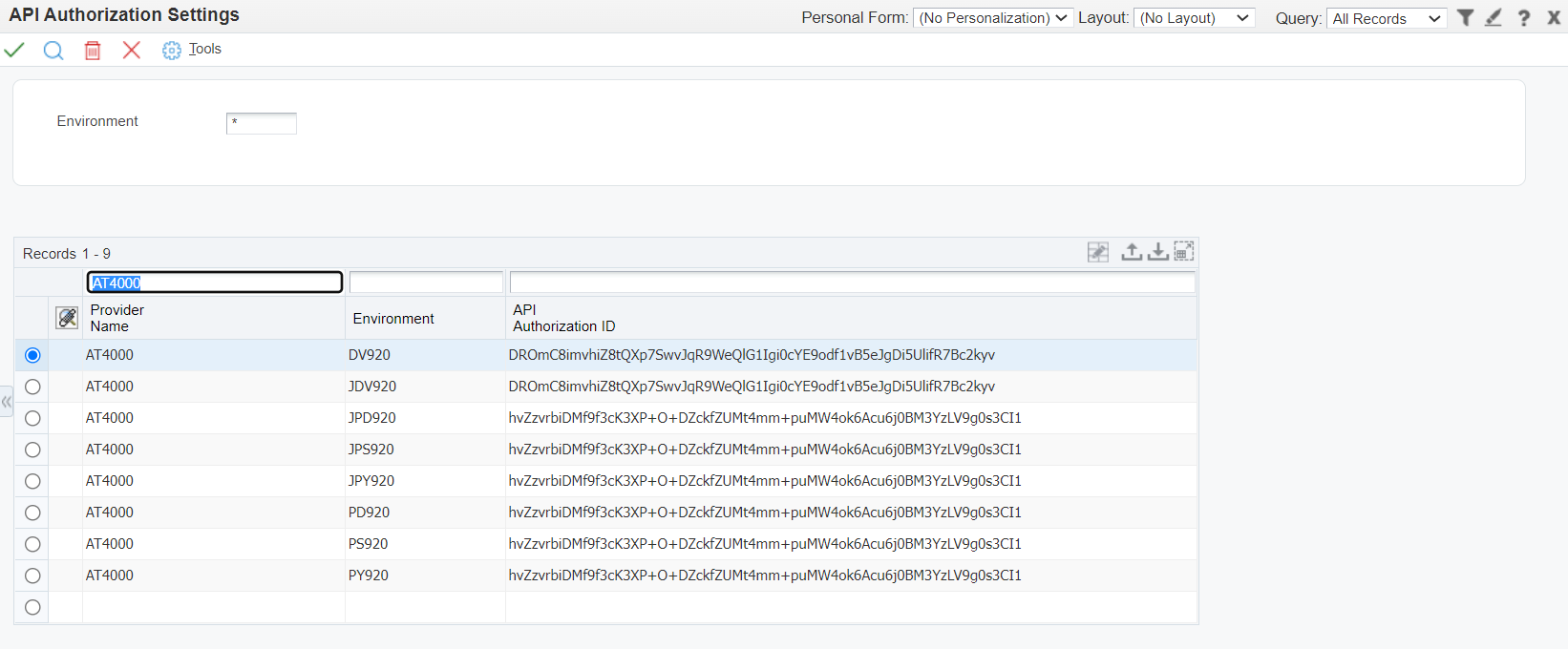

API Authorization Settings

Within Company Settings application (PQ67ATSY) take the form exit to API Auth and verify that API Authorization Settings have been configured based on provided installation guide recommendations. Provider Name (example “AT4000”), Environment (JDEdwards environment), API Authorization ID (API Access Token generated in the Tax Processing Console).

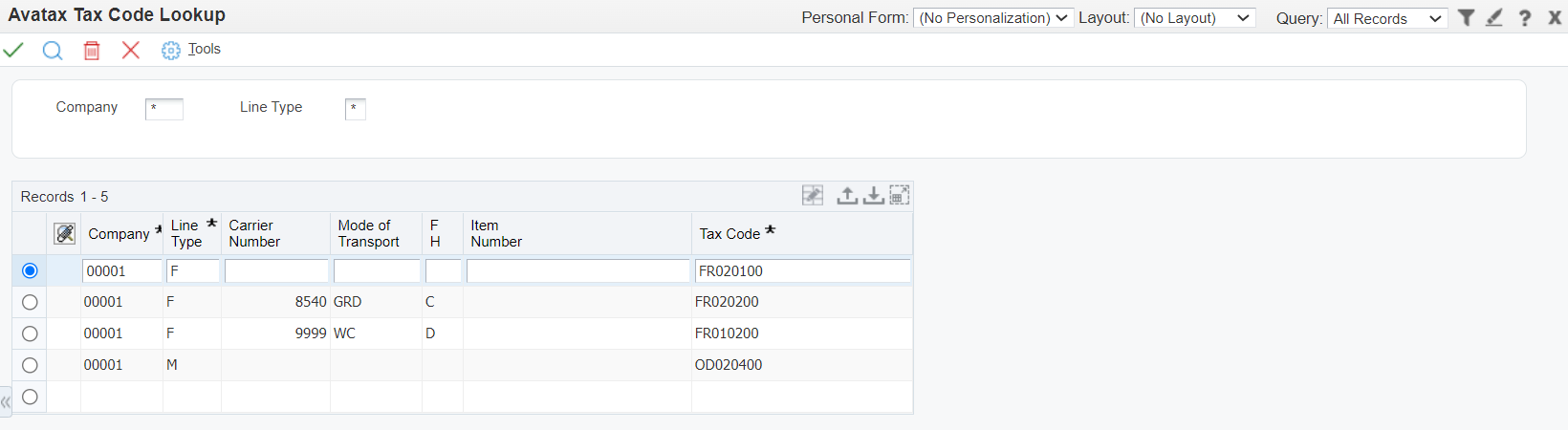

Avatax Tax Code Lookup

Within Company Settings application (PQ67ATSY) take the form exit to AT Tax Code. Tax codes are defined at the Item level and can be by Company, Line Type, Carrier Number, Mode of Transportation, Item Number.

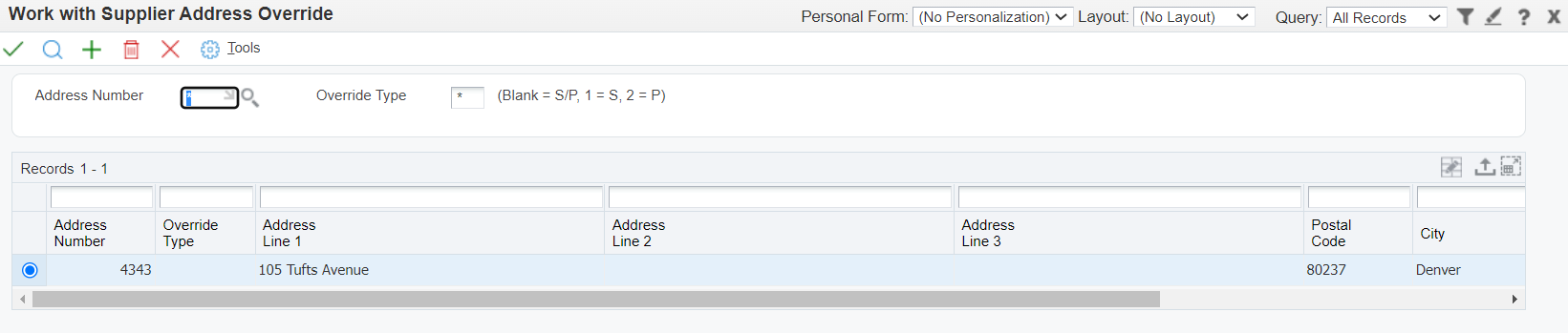

Work with Supplier Address Override

Within Company Settings application (PQ67ATSY) take the form exit to Supplier Address. Define the direct ship sales for the addresses to which an override can be made from where the supplier's commodity will leave.