Tax Code Definition

AvaTax subscribers have access to hundreds of AvaTax System Tax Codes, refer to available tax codes within AvaTax Administrator Console setup. A tax code is a unique identifying code for similar products, services, or charges that tells Avalara AvaTax what kind of sales tax, if any, to charge for them. Thousands of related tax rules power the tax engine to correctly process transactions for each jurisdiction in the United States and Canada. To take advantage of these tax rules, each product, service, or charge in JD Edwards and SmarterCommerce Ecommerce/POS applications may be mapped to an AvaTax System Tax Code. If a product, service or charge does not have a rule associated, it is simply taxed at the applicable rates for Origin, Destination and Nexus settings.

The SmarterCommerce Avalara AvaTax Connector passes the JD Edwards second item number (LITM) to the ItemCode field within the Get Tax calculation. The TaxCode related to the JD Edwards second item number is also passed and fetched from the item branch record category codes (F4102 - specific category code utilized is dependent on alias code setting within SmarterCommerce ATTAXCODE constant), if category code value in table is found <blank>, then value is fetched from the item master record category codes (F4101 - specific category code utilized is dependent on alias code setting within SmarterCommerce ATTAXCODE constant), and if category code value is still found <blank> then tax code is fetched based on AT Tax Code Definition form exit for a specific Company, Line Type, Carrier Number, Mode of Transport and Freight Handling Code as described below.

Alternatively, tax codes can be defined directly within the AvaTax Administrator Console. To specify Tax Codes for specific item numbers (ItemCodes) map the JD Edwards second item number (LITM) within the AvaTax Administrator Console (go to Organization > Items button) to its related TaxCode.

To map a specific Company, Line Type, Carrier Number, Mode of Transport or Freight Handling Code to a tax code go to Company Settings application (PQ67ATSY) form exit AT Tax Codes.

If you send a value in BOTH the ItemCode and the TaxCode fields to AvaTax, the behavior within the Get Tax calculation is as follows:

1. If the ItemCode sent is mapped to a TaxCode within the Avalara AvaTax Admin Console, the mapped TaxCode defined in the Avalara AvaTax Admin Console will be used for product taxability rules, regardless of what is sent in the TaxCode field of connector.

2. If the ItemCode sent is not mapped to a TaxCode within the Avalara AvaTax Admin Console, the TaxCode passed as part of the connector will be used for product taxability rules.

3. ItemCodes (JD Edwards second item numbers) that have, or are mapped to TaxCodes that have NO rule associated with them are simply taxed at the applicable rates for Origin, Destination and Nexus settings.

For Item TaxCode Definition

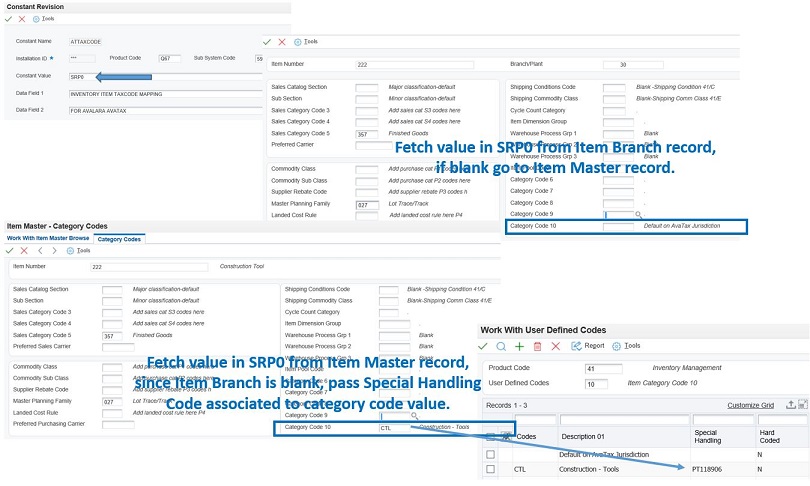

Group similar products, services or charges within the JD Edwards inventory system using the User Defined Code (UDC) table associated to alias defined in the ATTAXCODE constant, refer to Constants Settings constant value ATTAXCODE. Required AvaTax tax codes should be defined as special handling code values to its associated UDC value associated to the JD Edwards second item number (LITM). For example, if the ATTAXCODE is set to constant value SRP0 the system will utilize UDC table 41/10 to fetch the associated AvaTax tax code from the special handling code field of the UDC as reflected below. The tax code value will be retrieved considering the following rule:

1. The first level TaxCode fetch uses the UDC value associated to the JD Edwards second item number related to the item branch record (table F4102). If the value returned is not <blank>, the TaxCode retrieved is passed to Avalara AvaTax Get Tax calculation, else if the value is <blank> the process continues to next step.

2. The next level TaxCode fetch uses the UDC value associated to the JD Edwards second item number related to the item master record (table F4101). If the value returned is not <blank>, the TaxCode retrieved is passed to Avalara AvaTax Get Tax calculation, else if the value is <blank> the process continues to next step.

3. The next level TaxCode fetch uses the Freight TaxCode Definition and Generic or Custom TaxCode Definition table below. If the value returned is not <blank>, the TaxCode retrieved is passed to Avalara AvaTax Get Tax calculation, else if the value is <blank> the process continues to next step.

4. A <blank> value is passed in tax code field to the AvaTax Get Tax calculation.

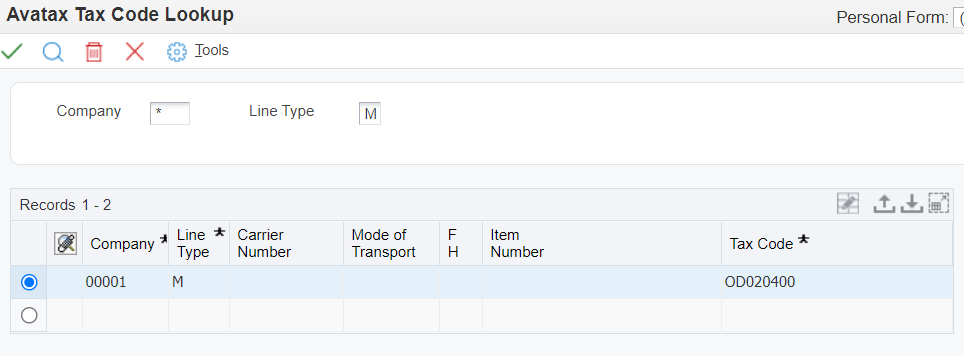

For Freight TaxCode Definition

Define the mapping of order line level company, order line level line type, order line level carrier, order line level mode of transportation (MOT), and order line level freight handling (FRTH) code to the appropriate Avalara AvaTax TaxCode considering the following rule:

1. The first level TaxCode fetch uses the Order Line Level Company, Order Line Level Line Type, Order Line Level Carrier, Order Line Level Mode of Transportation and Order Line Level Freight Handling Code. If a record is found, the TaxCode is retrieved and passed to Avalara AvaTax Get Tax calculation.

2. If no record is found, a fetch is executed using Company 00000, Order Line Level Line Type, Order Line Level Carrier, Order Line Level Mode of Transportation and Order Line Level Freight Handling Code. If a record is found, the TaxCode is retrieved and passed to Avalara AvaTax Get Tax calculation.

3. If no record is found, a fetch is executed using Order Line Level Company and Order Line Level Line Type only. If a record is found, the TaxCode is retrieved and passed to Avalara AvaTax Get Tax calculation.

4. If no record is found, a fetch is executed using Company 00000 and Order Line Level Line Type. If a record is found, the TaxCode is retrieved and passed to Avalara AvaTax Get Tax calculation.

For Generic or Custom TaxCode Definition

Define the mapping of order line level company and order line level line type to the appropriate AvaTax TaxCode considering the following rule:

1. The first level TaxCode fetch is executed using Order Line Level Company and Order Line Level Line Type only. If a record is found, the TaxCode is retrieved and passed to AvaTax Get Tax calculation.

2. If no record is found, a fetch is executed using Company 00000 and Order Line Level Line Type. If a record is found, the TaxCode is retrieved and passed to AvaTax Get Tax calculation.