Sales Invoice Consolidation

Invoice consolidation in JD Edwards allows you to combine multiple orders into a single invoice for a customer. SmarterCommerce integration with Avalara AvaTax respects this configuration.

Step 1

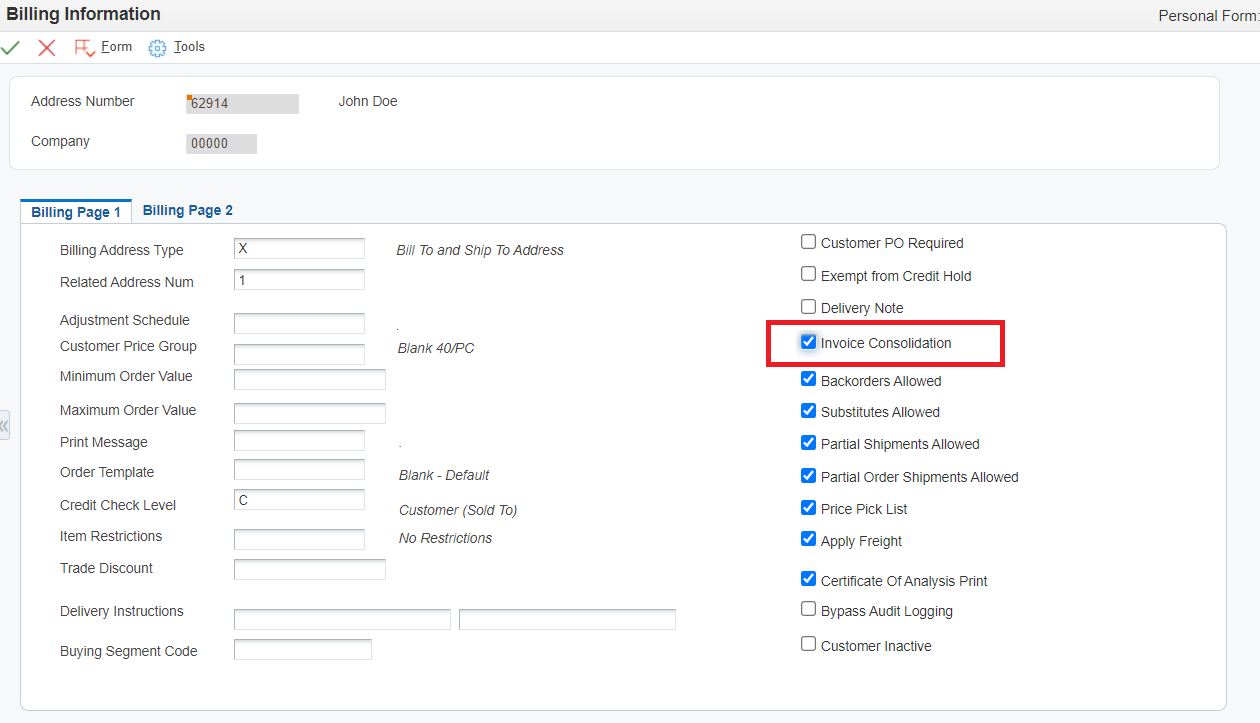

In JD Edwards go to the customer's AR|Billing record and configure the customer to receive consolidated invoicing.

Step 2

Enter an order for the customer. Continue to add items to the order verifying tax related fields, to execute Avalara AvaTax Get Tax calculation, set the Tax Rate/Area field of the order lines equal to the value defined in ATTAXAREAC constant. A tax rate/area set to <blank> or any value other than value found in constant will bypass call to Avalara AvaTax Get Tax calculation. Once all detail lines have been entered press OK. The Order Acceptance screen will be presented.

Step 3

The tax rate and amount will be returned by Avalara AvaTax. If satisfied place order. The sales order will be recorded for further processing.

Step 4

Continue entering orders for the same customer until all orders have been recorded. Once all orders have been entered you may use the Online Invoice functionality to confirm the tax amount per individual order.

Step 5

Continue to process the order through to Invoice Print (R42565).

.png)

The Sales Update (R42800) Processing Option "AvaTax Committed Next Status" is used to submit the “AvaTax Commit” transaction when all invoice lines next status are greater than this setting. If you are not using JDE consolidated invoices we recommend leaving this option blank.

This Section Also Contains

- Sales Order Information Flow

- Standard Sales Order

- Sales Order Using Call Center

- Sales Order with Non-Taxable Detail Line

- Direct Ship Sales Order

- Sales Order with Credit Card Payment

- Sales Order with PayPal Payments

- Sales Order in Foreign Currency

- Processing Taxable Sales Order with Transportation Management

- Credit Order

- Invoice Processing and Sales Update Report

- Avalara AvaTax Errors

- Avalara AvaTax Transaction Information