Constants Settings

In JD Edwards EnterpriseOne

Within SmarterCommerce Constants Settings application (PQ670004) configure the following required constants necessary for Avalara AvaTax Get Tax calculation.

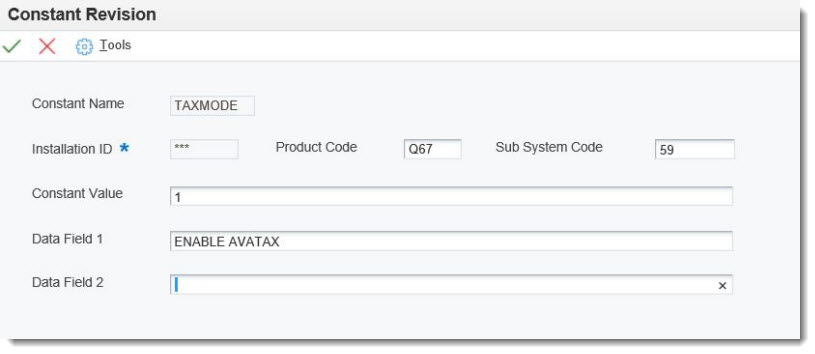

1. Avalara AvaTax Active - Constant Name TAXMODE

To activate (enable) the SmarterCommerce AvaTax Connector for JD Edwards set the TAXMODE constant equal to 1. Any value different than 1 will disable the Avalara AvaTax functionality.

.png)

When AvaTax is active, please ensure Vertex is inactive. Please visit Work With Vertex Q Series Constants Revision (P7306) to turn Vertex off when AvaTax is activated.

2. Avalara AvaTax Default Currency - Constant Name ATDOMCURR

Is currency conversion active within JD Edwards environment? (A code that specifies whether to use multi-currency accounting, and the method of multi-currency accounting to use.) Currency conversion is active if JD Edwards multi-currency conversion constant is set to ‘Y’ or ‘Z’. If currency conversion is NOT active within JD Edwards set default company currency within ATDOMCURR for Avalara AvaTax.

.png)

3. Avalara Connection Validation - Constant Name ATVALCONCO

To ping active communication connection with Avalara AvaTax services, set default Avalara AvaTax company code to be used during communication attempt. No tax processing occurs, use is mainly to validate communication with service. Only one company code is necessary.

.png)

4. Avalara Address Validation - Constant Name ATVALADDCO

If Avalara AvaTax Validate Address is ACTIVE (Yes), set default Avalara AvaTax company code to be used during Validate Address processes. Only one company code is necessary.

.png)

.png)

The company code used for constants ATVALCONCO and ATVALADDCO may be the same or different. However, must be valid company codes in AvaTax Administrator Console.

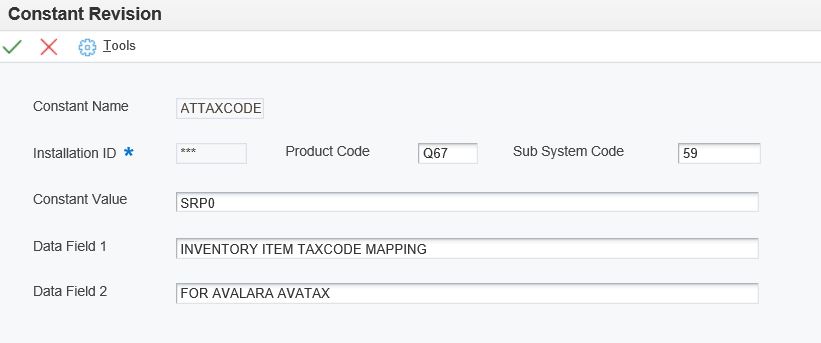

5. Avalara Item Level Tax Code - Constant Name ATTAXCODE

The inventory category code alias set within constant value of ATTAXCODE will be utilized to retrieve the tax code (TAXCODE) value to be passed with the associated item code (JD Edwards second item number - LITM). For additional information on tax codes refer to Tax Code Definition section of this guide.

6. JD Edwards Tax Rate/Area - Constant Name ATTAXAREAC

To execute Avalara AvaTax Get Tax calculation, set the Tax Rate/Area field of the sales order or invoice (customer master) equal to the value defined in constant. By setting eligible tax rate/area the Avalara AvaTax Get Tax functionality will be executed. A tax rate/area set to <blank> or any value other than value found in constant will bypass call to Avalara AvaTax Get Tax calculation for sales order processing and invoice processing. Value assigned to constant ATTAXAREAC (used for sales order and invoice processing) MUST DIFFER from value assigned to ATTAXAREAV (used for purchase order and voucher match processing) in setting #7 below. Value assigned to ATTAXAREAC and ATTAXAREAV must exist in P4008 with 0% tax when AvaTax in use.

.png)

.png)

If you are using SmarterCommerce CMS, POS, Call Center, etc you must also go to Tax Information Revisions (PQ674216) and verify that you have a range such as 00000-99999 pointing to this ATTAXAREAC constant value.

7. JD Edwards Tax Rate/Area - Constant Name ATTAXAREAV

To execute Avalara AvaTax Get Tax calculation, set the Tax Rate/Area field of the purchase order or voucher match (supplier master) equal to the value defined in constant. By setting eligible tax rate/area the Avalara AvaTax Get Tax functionality will be executed. A tax rate/area set to <blank> or any value other than value found in constant will bypass call to Avalara AvaTax Get Tax calculation for purchase order and voucher match processing. Value assigned to constant ATTAXAREAV (used for purchase order and voucher match processing) MUST DIFFER from value assigned to ATTAXAREAC (used for sales order and invoice processing) in setting #6 above. Value assigned to ATTAXAREAC and ATTAXAREAV must exist in P4008 with 0% tax when AvaTax in use.

.png)

8. Avalara Status Limit Within Address Validation - Constant Name ATNXTFROM

To limit the update of the address line fields on an Address Book record when active sales orders exist for ship to address book record set the status range (begin status - from) to define active sales orders, locking down the address lines of the address book record from update.

.png)

9. Avalara Address Validation - Constant Name ATNXTTHRU

To limit the update of the address line fields on an Address Book record when active sales orders exist for ship to address book record set the status range (end status - thru) to define active sales orders, locking down the address lines of the address book record from update.

.png)

10. Sales Order Error Hold Code - Constant Name ATHOLDCODE

During invoice processing (generation of invoices) if an error in communication with Avalara AvaTax occurs or if Avalara AvaTax returns an error the invoice will be placed on hold to stop Sales Order Update Posting (R42800). Hold code should be defined within standard JD Edwards hold code processing and constant should be configured with SmarterCommerce constants application.

.png)

11. Special Characters - Constant Name ATSPCHARAL

Define the special characters allowed for AvaTax transactions.

.png)

12. AvaTax Country Code - Constant Name ATDOMCTR

The country code to be used by default when country is not defined on the JDE record being utilized.

.png)

Copyright © 2020 Premier Group

4.0.0.0