Standard Purchase Order

For the purpose of illustrating Avalara AvaTax Tax Calculation when integrated with SmarterCommerce a "standard order" is one where there are no errors or exceptions and the purchase order document type is active based on UDC Definitions within UDC 59 / AO - Avalara AvaTax Temporary Order Documents and UDC 59 / AT - Avalara AvaTax Country Validation.

Tax Calculation uses the origin, supplier address associated to purchase order Supplier Number found in the Supplier Address Override table for Override Type BLANK or '2' ( see Supplier Address Overrides ) and if an override is not found within Supplier Address Override table then the supplier's address will be retrieved from the address book and destination address, ship to address number associated to purchase order line or ship to address override for entire order, if one exists to determine the proper tax rate per order.

Both the two step and three step methods of processing a Purchase Order with Avalara AvaTax Get Tax Calculation will be illustrated below. Please refer to the Purchase Order Information Flow diagram for further information.

Three Step Method - The three step method of processing a purchase order in JD Edwards consists of PO Entry (P4310), Purchase Order Receiving (P4312), and Voucher Match (P4314).

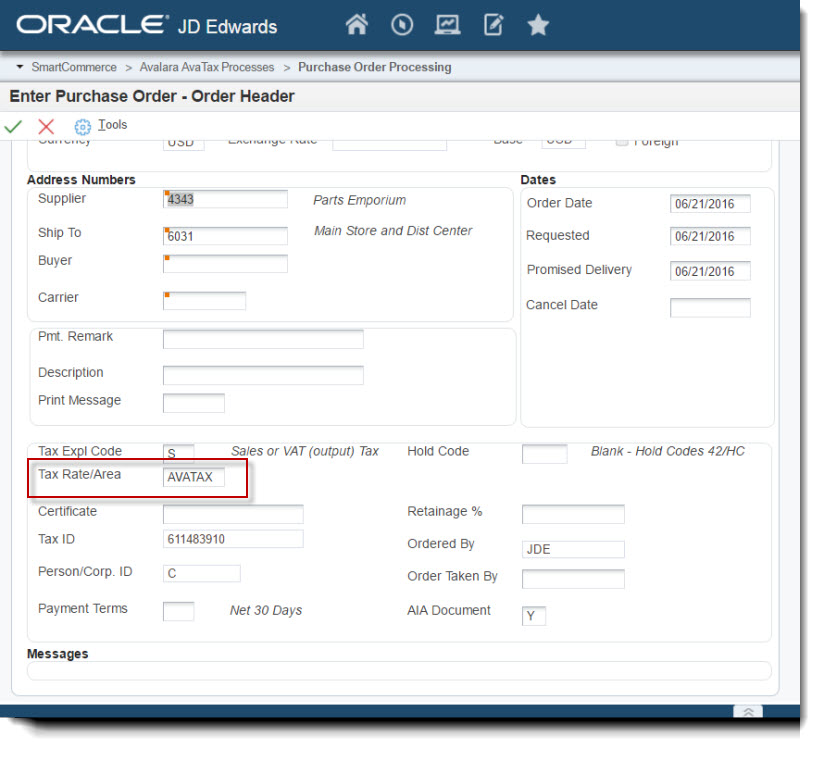

Step 1

Enter purchase order verifying tax related fields (to execute Avalara AvaTax Get Tax calculation set the Tax Rate/Area field of the order lines equal to the value defined in ATTAXAREAV constant - refer to Constants Settings) are entered correctly. A tax rate/area set to <blank> or any value other than value found in ATTAXAREAV constant will bypass call to Avalara AvaTax Get Tax calculation. Once all PO detail lines have been entered as desired press OK. The Order Acceptance screen will be presented.

Step 2

Once the purchase order has been saved you may use the Order Summary row exit to verify the estimated tax calculated by Avalara AvaTax.

.jpg)

Step 3

Now, print the purchase order which will include estimated tax calculated by Avalara AvaTax.

.jpg)

Step 4

Now, enter the PO receipts and perform the voucher match. Ensure that the Tax column is visible during voucher match so that you may enter the tax reflected on the supplier's invoice if different than use tax calculated by AvaTax.

.jpg)

Notice that in this example the tax calculated by Avalara AvaTax exceeds the tax reflected on the supplier's invoice. Once all voucher information has been entered save the voucher.

.jpg)

Step 5

Due to fact that the tax calculated by Avalara AvaTax exceeds the tax reflected on supplier's invoice a pop-up notification will appear advising you that there is a difference in the tax estimated (if the tax reflected on supplier's invoice exceeds or is equal to tax calculated by Avalara AvaTax then no pop-up notification will appear). If the desire is to save the Use Tax difference to the AvaTax history click OK button, to ignore difference click on Cancel button.

.jpg)

Step 6

Once the voucher is saved, if desired, you can login to the Avalara AvaTax Administrator Console account to confirm the difference in tax for the transaction was written. Please note that the difference between the calculated tax and the tax reflected on supplier's invoice is recorded in Avalara AvaTax when the voucher is matched in JD Edwards and the difference was saved.

.jpg)

Two Step Method - The two step method of processing a purchase order in JDEdwards consists of PO Entry (P4310) and Voucher Match (P4314) only.

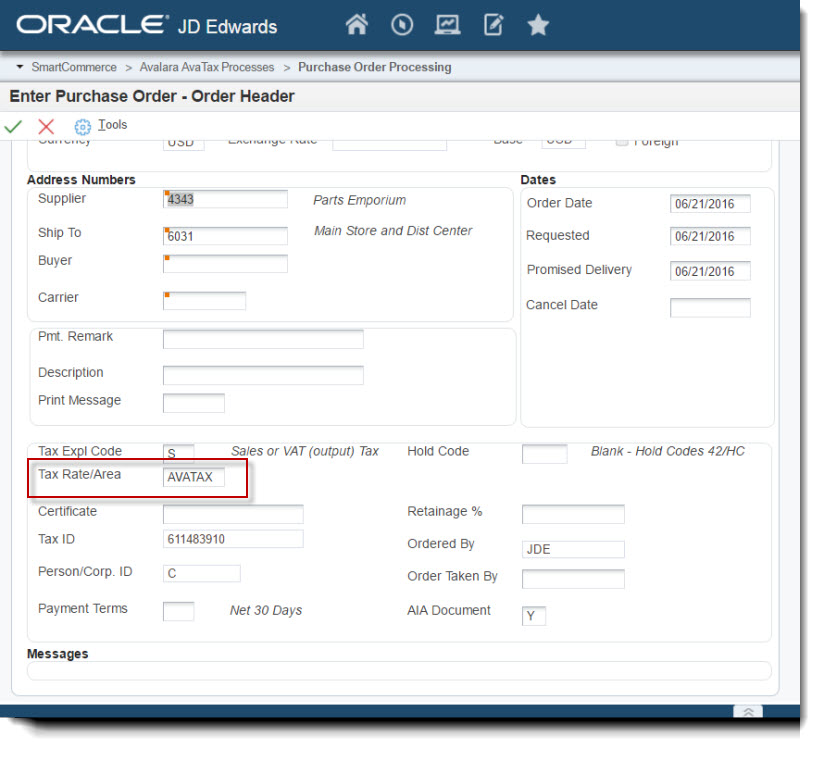

Step 1

Enter purchase order verifying tax related fields (to execute Avalara AvaTax Get Tax calculation set the Tax Rate/Area field of the order lines equal to the value defined in ATTAXAREAV constant - refer to Constants Settings) are entered correctly. A tax rate/area set to <blank> or any value other than value found in ATTAXAREAV constant will bypass call to Avalara AvaTax Get Tax calculation. Once all PO detail lines have been entered as desired press OK. The Order Acceptance screen will be presented.

Step 2

Once the purchase order has been saved you may use the Order Summary row exit to verify the estimated tax calculated.

.jpg)

Step 3

Now, enter the PO receipts and perform the voucher match. Ensure that the Tax column is visible during voucher match so that you may enter the actual tax based on the supplier's invoice if different than use tax calculated by AvaTax.

.jpg)

Notice that in this example the tax calculated by Avalara AvaTax exceeds the tax reflected on the supplier's invoice. Once all voucher information has been entered save the voucher.

.jpg)

Step 4

Due to fact that the tax calculated by Avalara AvaTax exceeds the tax reflected on supplier's invoice a pop-up notification will appear advising you that there is a difference in the tax estimated (if the tax reflected on supplier's invoice exceeds or is equal to tax calculated by Avalara AvaTax then no pop-up notification will appear). If the desire is to save the Use Tax difference to the AvaTax history click OK button, to ignore difference click on Cancel button.

.jpg)

Step 5

Once the voucher is saved, if desired, you can login to the Avalara AvaTax Administrator Console account to confirm the difference in tax for the transaction was written. Please note that the difference between the calculated tax and the tax reflected on supplier's invoice is recorded in Avalara AvaTax when the voucher is matched in JD Edwards and the difference was saved.

.jpg)

Copyright © 2007-2018 Premier Group

3.0.0.0